Cheating Spouse: What You Need to Know

Divorce is never easy, but when infidelity is involved, it adds another layer of emotional and financial complexity. If you are considering ending a marriage due to infidelity, it’s essential to consult with Legal Counsel to understand your rights, how infidelity can impact the divorce process, and how professionals like Certified Divorce Financial Analysts (CDFA) can assist you in navigating these challenges. This blog post will delve into these aspects, offering insights and guidance for anyone facing the difficult decision to divorce a cheating spouse.

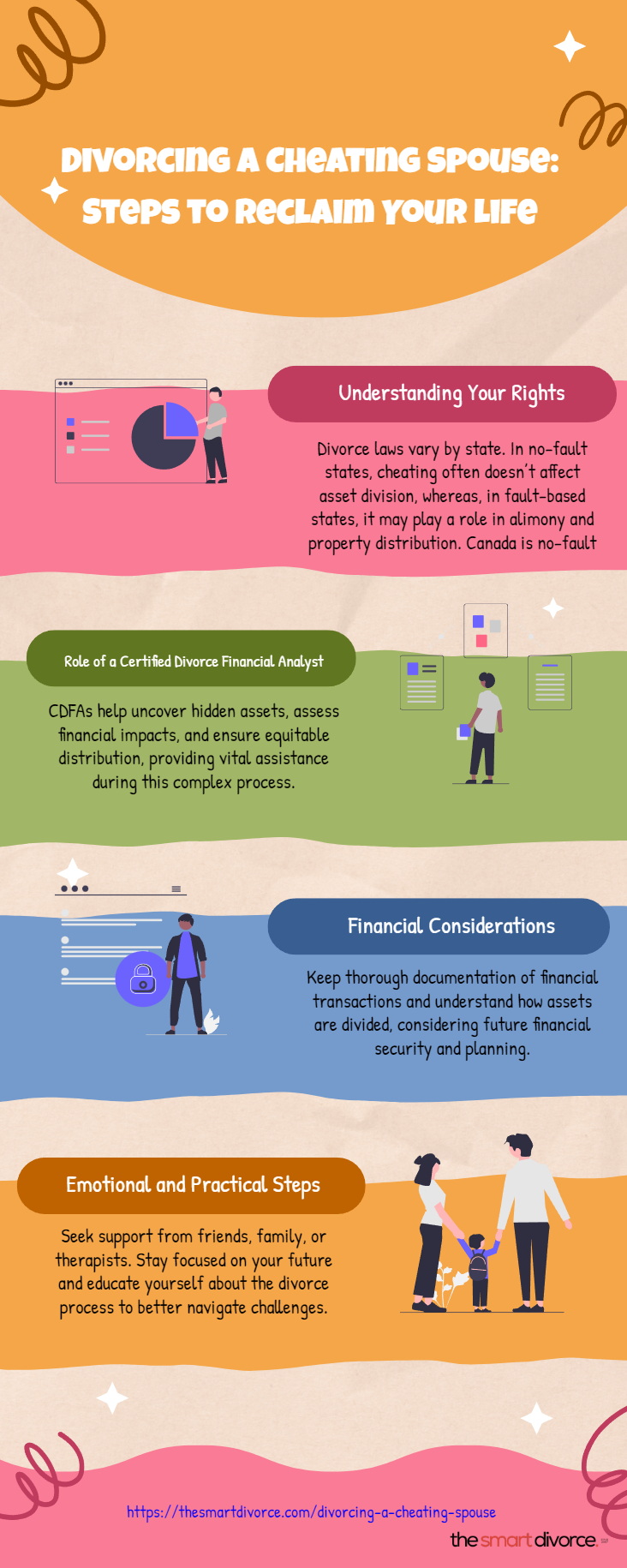

Understanding Your Rights in a Divorce Due to Cheating

In many jurisdictions, the impact of a spouse’s infidelity on divorce proceedings varies. It’s a common misconception that divorcing a cheating spouse will automatically result in a more favourable settlement for the wronged party. However, this is not always the case. Here’s what you need to know:

- No-Fault Divorce States: In no-fault divorce states, infidelity usually has little to no impact on the division of assets or alimony, highlighting the importance of Asset Protection strategies. Courts in these states focus on equitable distribution, dividing assets fairly, not necessarily equally.

- Fault-Based Divorce States: Some states still allow fault-based divorces where infidelity can be a factor in determining alimony or property division. However, proving infidelity and demonstrating its financial impact can be challenging even in these states.

- Financial Reimbursement for Infidelity: In cases where a spouse has spent marital funds on an affair—such as buying expensive gifts, vacations, or other lavish expenses—courts may require that those funds be reimbursed. However, this often results in a partial return, such as getting back 50 cents on the dollar for every dollar spent rather than a full reimbursement.

The Role of a Certified Divorce Financial Analyst (CDFA)

Navigating the financial implications of divorce, especially when infidelity is involved, can be complex. A Certified Divorce Financial Analyst (CDFA) plays a crucial role in this process by:

- Providing a Clear Financial Picture: A CDFA helps you understand the financial landscape, including identifying all marital assets and liabilities. This is especially important in cases of infidelity, where hidden spending or concealed assets may be an issue, underscoring the need for strategic Asset Protection.

- Evaluating the Impact of Infidelity on Finances: If your spouse has been financially supporting someone outside the marriage, a CDFA can help calculate the exact financial impact and present this information to the court. This can be crucial in arguing for a more favourable settlement.

- Ensuring Equitable Distribution: By understanding the nuances of state laws, a CDFA ensures that the division of assets is fair and considers any financial misconduct related to infidelity. They can work alongside your attorney to build a comprehensive case that highlights any financial disparities caused by your spouse’s cheating.

Financial Considerations When Divorcing a Cheating Spouse

Divorcing a Cheating Spouse requires careful financial planning to ensure that you emerge from the process with your financial health intact. Here are some key considerations:

- Document Everything: Keep detailed records of all financial transactions, including any suspicious spending that may suggest infidelity. This documentation can be vital in court and for your CDFA in assessing the economic impact of your spouse’s actions.

- Understand the Division of Assets: Not all assets are divided equally in a divorce. Factors such as the duration of the marriage, contributions to the marital estate, and each spouse’s financial needs are considered.

- Consider Long-Term Financial Security: Beyond immediate concerns, Legal Counsel should work alongside a CDFA to consider your long-term financial well-being. A CDFA can help you project future financial scenarios based on different settlement options, ensuring you make informed decisions to protect your financial future.

How to Work with a Certified Divorce Financial Analyst

If you’re considering or currently going through a divorce due to infidelity, working with a CDFA can provide significant advantages:

- Initial Consultation: Start with a consultation to understand the services a CDFA offers and how they can assist you, specifically in an infidelity case.

- Collaborate with Your Legal Team: Your CDFA should work closely with your Legal Counsel to ensure that all financial evidence is presented clearly and effectively in court.

- Focus on Financial Recovery: A CDFA helps not only divide assets but also plans for financial recovery post-divorce. This includes budgeting, planning for future expenses, and understanding the potential tax implications of the divorce settlement.

The Emotional and Practical Steps of Divorcing a Cheating Spouse

Beyond the financial aspects, divorcing a cheating spouse involves emotional and practical steps to consider:

- Seek Support: Divorce can be emotionally draining, especially when infidelity is involved. Seeking support from friends, family, or a therapist can help you navigate this challenging time.

- Stay Focused on the Future: Getting caught up in the emotions of betrayal is easy, but staying focused on your future—both emotionally and financially—will help you move forward more healthily.

- Educate Yourself: Knowledge is power. Educate yourself on the divorce process, your rights, including parenting privileges, and what to expect. The more you know, the better equipped you’ll be to handle the challenges ahead.

Final Thoughts

Divorcing a cheating spouse is never easy, but understanding your rights and the financial implications can help you navigate this complex process more effectively. A Certified Divorce Financial Analyst (CDFA) can be a valuable ally, providing clarity and guidance as you work toward a fair and equitable settlement when dissolving a marriage with infidelity issues. Remember, while the emotional toll of infidelity can be overwhelming, taking a proactive approach to your financial strategy will help you emerge more robust and more secure.

At The Smart Divorce

If you’re experiencing the pain of infidelity and considering divorce, you’re not alone. At The Smart Divorce, we understand your unique challenges and are here to help. Our team of Certified Divorce Financial Analysts (CDFA) and Divorce Coaches can provide the support and expertise you need to make informed decisions and confidently move forward. Schedule a Complimentary Get-Acquainted Call today using this link: https://booknow.dtsw.me/#/thesmartdivorce.

Key Takeaways

- Infidelity’s impact on divorce varies depending on state laws.

- No-fault states generally do not consider infidelity in asset division.

- Some states may allow for financial reimbursement for expenses related to infidelity.

- A Certified Divorce Financial Analyst (CDFA) helps assess financial impact and ensures fair distribution.

- Documentation of financial transactions is crucial in cases of infidelity.

- CDFAs work with legal teams to present a comprehensive financial picture in court.

- Consider long-term financial security when negotiating settlements.

- Emotional support and focusing on the future are critical steps in recovering from a divorce.

- Education on divorce rights and processes empowers better decision-making.

- The Smart Divorce offers a supportive environment with professional expertise.

- Scheduling a complimentary consultation can provide clarity and direction.