The Dangers of Self-Representing in a Family Law Case

Navigating a divorce is already a challenging and emotional journey, especially when considering issues of Custody. For some, self-representing in a family law case is a viable option to save on legal fees or maintain control over the process. However, while the intent may be well-meaning, this approach can often lead to significant pitfalls and complications. This post explores the potential dangers of self-representation in a family law case. It offers insights on how a Certified Divorce Financial Analyst (CDFA) can assist in making more informed decisions.

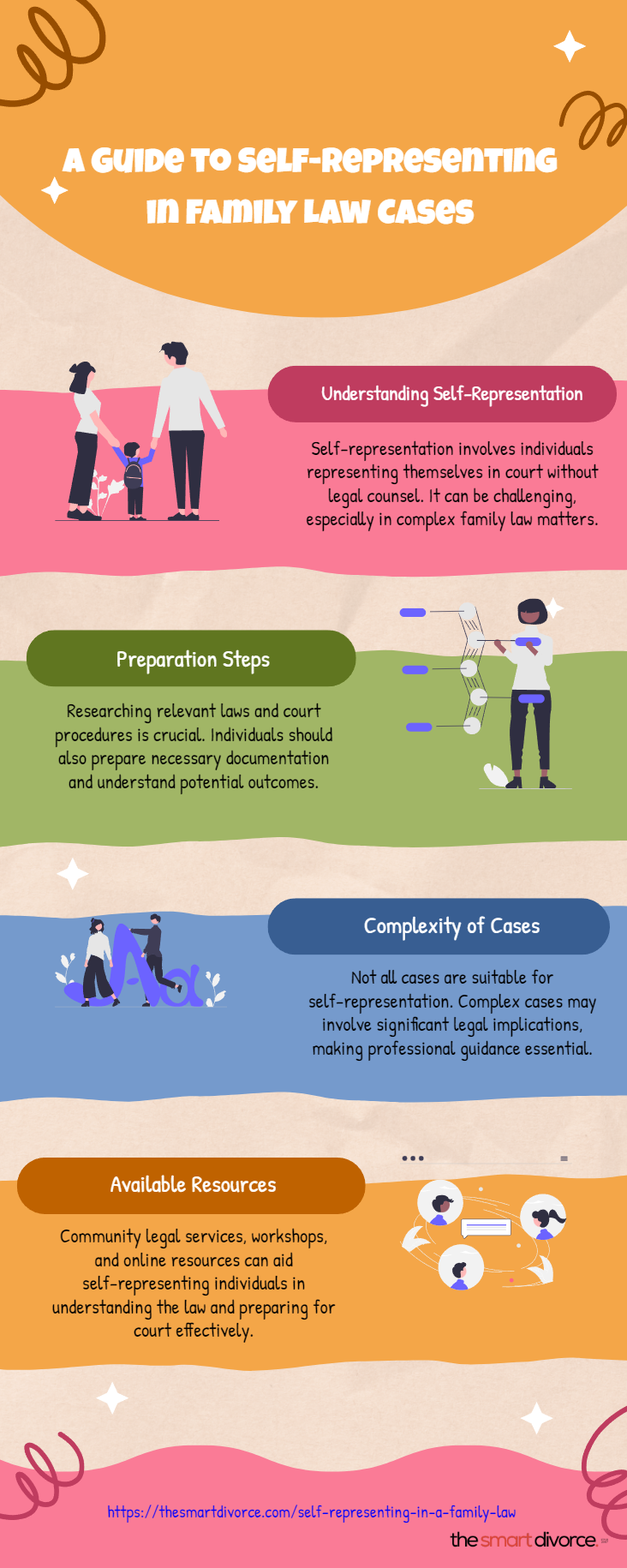

Understanding the Risks of Self-Representation

While self-representing might initially appear cost-effective, there are several critical risks to consider that could ultimately cost you more in the long run:

- Locked-Up Assets: If you decide to sell assets without settling, the proceeds could be locked away until you agree. For instance, if you sell a jointly owned property, the money might be held in a solicitor’s or conveyancer’s trust account. This can happen especially if a caveat has been lodged, requiring a court order or mutual settlement before the funds are released. The other party could also apply for freezing orders, further complicating access to your assets.

- Tax Implications: Selling assets may also trigger various taxes, including capital gains tax (CGT). Depending on your circumstances, this could be beneficial if it aligns with your marginal tax rates or if the gains can be shared equitably as part of the settlement. However, triggering these taxes might be something other than financially wise in many cases. You might prefer to retain certain assets or transfer them under specific family law arrangements to benefit from tax rollover relief.

- Potential for Below-Market Sales: Unilaterally selling assets without your ex-partner’s consent could lead to accusations that the assets were sold below market value. This opens up the possibility of the other party arguing that the shortfall should be compensated, potentially requiring retrospective valuations or even setting aside transactions if they are seen as attempts to defeat a claim. This can lead to costly and stressful court proceedings.

- Impact on Retirement Plans: For those nearing retirement, liquidating assets can severely affect your financial stability. For instance, selling your principal place of residence could disqualify you from age pension eligibility or impact your estate planning. Engaging with a financial advisor and seeking Legal Aid can help you navigate these intricacies alongside your family law advice.

The Role of a Certified Divorce Financial Analyst (CDFA)

A CDFA can be an invaluable resource when navigating the financial complexities of divorce. They offer a range of services, including:

- Financial Analysis: A CDFA can comprehensively analyze your financial situation, helping you understand the long-term implications of various settlement options. This can prevent costly mistakes like triggering unnecessary taxes or selling assets at an inopportune time.

- Tax Planning: They can help you plan for divorce-related taxes, ensuring you make informed decisions that minimize your tax liability.

- Retirement Planning: With expertise in financial planning, a CDFA can advise on how to protect your retirement funds and maximize your assets during the divorce process.

- Cash Flow and Budgeting: They assist in creating a realistic post-divorce budget, helping you understand your new financial landscape and plan accordingly.

Why You Should Seek Professional Advice

The complexities involved in family law cases, including the Guardianship of children, mean that professional advice is not just a luxury but a necessity. Here’s why:

- Avoiding Costly Mistakes: Family law is intricate, and without legal aid, you might unknowingly make decisions that could have negative financial consequences, both short-term and long-term.

- Ensuring Fair Settlements: Professional legal advice and legal aid services ensure that your settlement is fair and just, considering all aspects of your financial situation. A family lawyer can guide you through the process and ensure all legal standards are met.

- Reducing Emotional Stress: Divorce is emotionally taxing. A team of professionals, including a lawyer and a financial advisor, can help you manage stress by handling complex tasks, allowing you to focus on healing and moving forward.

Critical Considerations Before Deciding to Self-Represent

Before deciding to self-represent in your family law case, consider the following:

- Get Professional Legal and Financial Advice: Always consult with a family lawyer and financial advisor to understand the full scope of your Family Court situation.

- Assess the Complexity of Your Case: If your case involves significant assets, complex financial situations, or contentious issues, professional representation is often crucial.

- Understand the Emotional and Time Investment: Representing yourself requires significant time and emotional energy. Ensure you are prepared for this commitment.

- Evaluate Potential Financial Impacts: Before making any decisions, be aware of all potential financial implications, from tax liabilities to the risk of losing your pension.

Other Help For Self-Representing in a Family Law in Ontario

The University of Windsor offers a one-of-a-kind program, a rare opportunity that can be highly beneficial for individuals who are self-representing in a family law case in Ontario. Here’s some information about this exclusive program:

University of Windsor – National Self-Represented Litigants Project (NSRLP): A reputable initiative by the University of Windsor.Website: National Self-Represented Litigants Project (NSRLP)

Description: The National Self-Represented Litigants Project (NSRLP) initiative by the University of Windsor provides extensive resources for self-represented litigants across Canada, including those in Ontario. The program supports individuals navigating Family Court without a lawyer.

Key Features of the NSRLP:

- Resource Library: The NSRLP offers a comprehensive online resource library that leaves no stone unturned. It includes guides, tip sheets, and videos on various aspects of self-representation in family law cases. Topics covered include court procedures, understanding legal documents, and preparing for court appearances.CanLII Primer: This primer is a guide to using CanLII, a free legal research tool. It helps self-represented individuals access legal precedents and understand how to use them in their cases.

- Access to Justice Resources: The NSRLP provides resources to improve access to justice, including research reports on self-represented litigants’ challenges and strategies for navigating the legal system more effectively.

- Blog and Stories: The NSRLP website features a blog and stories from other self-represented litigants, offering personal insights and practical advice that can inspire and motivate those who have gone through the process.Research and Advocacy: The program researches the experiences of self-represented litigants and advocates for systemic changes to make the legal system more accessible.

- Toolkits: The NSRLP provides specific toolkits for various stages of legal proceedings, including how to prepare for a hearing, communicate effectively with court staff and judges, and manage your case effectively.

How NSRLP Can Assist Self-Representing Individuals:

- Education and Empowerment: The resources provided by NSRLP help individuals understand the legal process, empowering them to navigate their cases more confidently.

- Community Support: The program fosters a sense of community and support among individuals going through similar experiences by sharing stories and advice from other self-represented litigants, especially regarding the Guardianship of children.

Practical Guidance: The program’s tools and resources are not just theoretical but are designed to provide practical, actionable advice to help self-represented individuals handle their cases more effectively and avoid common pitfalls.The University of Windsor’s NSRLP is an excellent resource for anyone considering or currently self-representing a family law case in Ontario. By utilizing the extensive resources and support offered by the program, individuals can better understand the legal process and improve their chances of a successful outcome. We encourage you to explore the NSRLP resources and take advantage of the support available to you.

Final Thoughts

Navigating a divorce is challenging enough without the added complications of legal and financial pitfalls. While self-representation might seem appealing, the risks often outweigh the benefits. Engaging with a Certified Divorce Financial Analyst (CDFA) and a family lawyer can provide you with the knowledge and support needed to make informed decisions, protect your financial future, and reduce the stress associated with divorce in Family Court.

At The Smart Divorce

At The Smart Divorce, we understand the emotional and financial complexities of ending a marriage. If you’re considering self-representation or need guidance through your divorce, we’re here to help. We offer various services tailored to your needs, including financial planning and legal support, to help you navigate your separation during this challenging time.

If you’re ready to take the next step or want to learn more about how we can assist you, we invite you to schedule a Complementary Get-Acquainted Call with us today using this link: Book a Call with The Smart Divorce. Let us help you make intelligent, informed decisions for your future.

Summary of Key Takeaways

- Self-representation in divorce cases can lead to locked-up assets, complicating financial settlements.

- Selling assets without a settlement can result in funds being held in a trust account, pending legal resolution.

- There are significant tax implications when liquidating assets, potentially triggering capital gains tax.

- Unilateral asset sales could be challenged in court, leading to additional legal fees and complications.

- Liquidating assets might adversely affect retirement plans, pension eligibility, and your ability to provide Child Maintenance.

- A Certified Divorce Financial Analyst (CDFA) can provide crucial financial analysis, tax planning, and retirement advice.

- Professional advice ensures that divorce settlements are fair and minimize negative financial consequences.

- Self-representation, especially in cases involving child aid, requires a significant emotional and time investment, which can add to stress.

- Legal professionals help reduce the emotional burden by managing complex aspects of divorce proceedings.

- Before self-representing, consider the complexity of your case and potential financial impacts.

- The Smart Divorce offers comprehensive support, including financial planning and legal advice, to guide you through the divorce process.